Budget Overview

School Funding in California

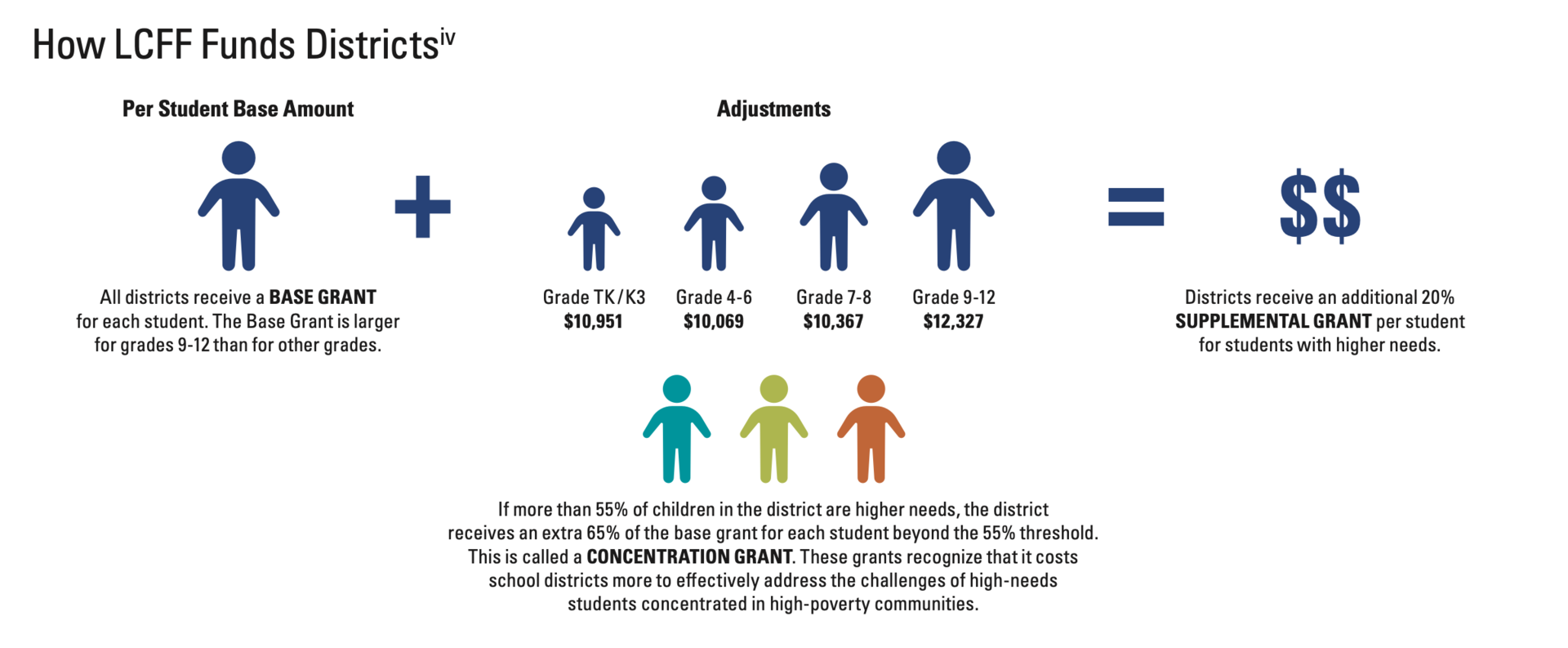

- Base Funding for each attending student (grade-span adjusted) → +20% Supplemental for each student who is EL/low-income/homeless/foster → +65% Concentration for each high-need student above 55% of enrollment.

- Equity Multiplier (newer): Extra support can flow to school sites where >70% of students are socioeconomically disadvantaged (added in 2023–24).

- Local Control with Guardrails: LCFF funds are largely unrestricted, but districts must use supplemental/concentration funds consistent with the law’s intent to increase/improve services for high-need students.

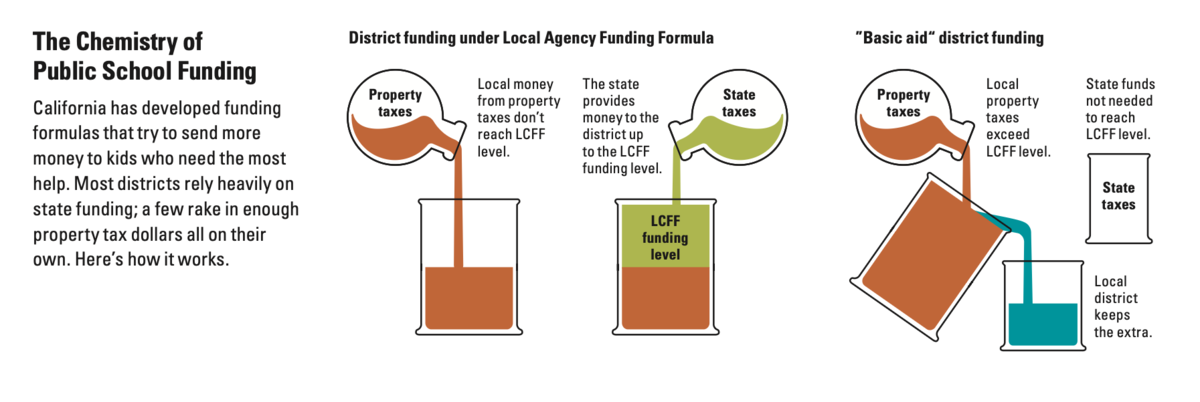

Community-Funded/"Basic-Aid" vs. LCFF-Funded Districts

Some school districts - about 14% of the school districts in California - are funded primarily through local property taxes rather than state funds. These are called community-funded school districts (previously known as "Basic Aid.") These districts serve approximately 5% of the total public school enrollment in California. On a per student basis, these school districts spend approximately 31% more than their LCFF-funded. Lafayette School District is an LCFF-Funded school district.

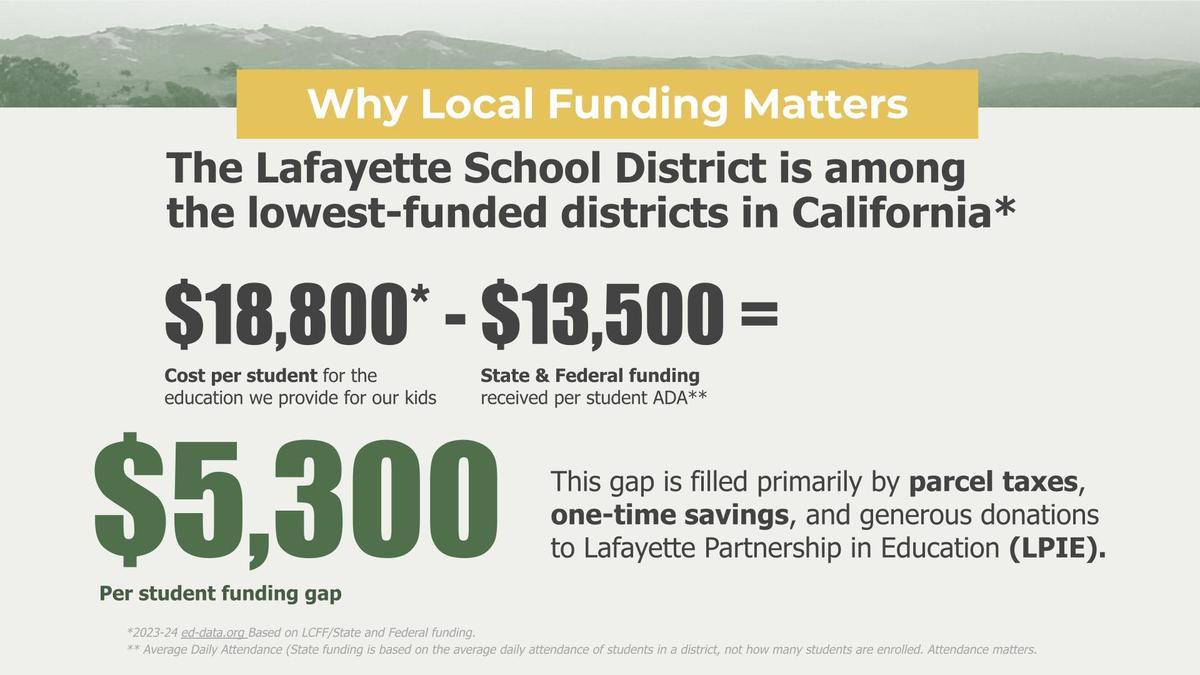

The Importance of Local Funding

In Lafayette, relatively few students qualify for the categories of additional funding through LCFF, so the District receives limited supplemental funding and no concentration funding. Equity is essential—but LCFF’s base grant still does not fully cover the cost of a well-rounded education for any district.

Local support, specifically parcel taxes and education foundation donations, is what closes the gap and sustains programs beyond the basics.

Why Local Funding Matters

- State revenue is volatile. California’s school funding swings with the economy; it can fall fast in recessions and rebound inrecoveries. Local dollars help stabilize programs through the ups and downs.

- Local funds stay local. Community measures (e.g., parcel taxes) and education-foundation donations supplement LCFF and are used for priorities set close to home. (Passing local taxes in California requires high voter thresholds.) In Lafayette, Measures J&B and L (parcel taxes) and Lafayette Partners in Education (LPIE) consist of 20% of the District's annual general fund revenue.

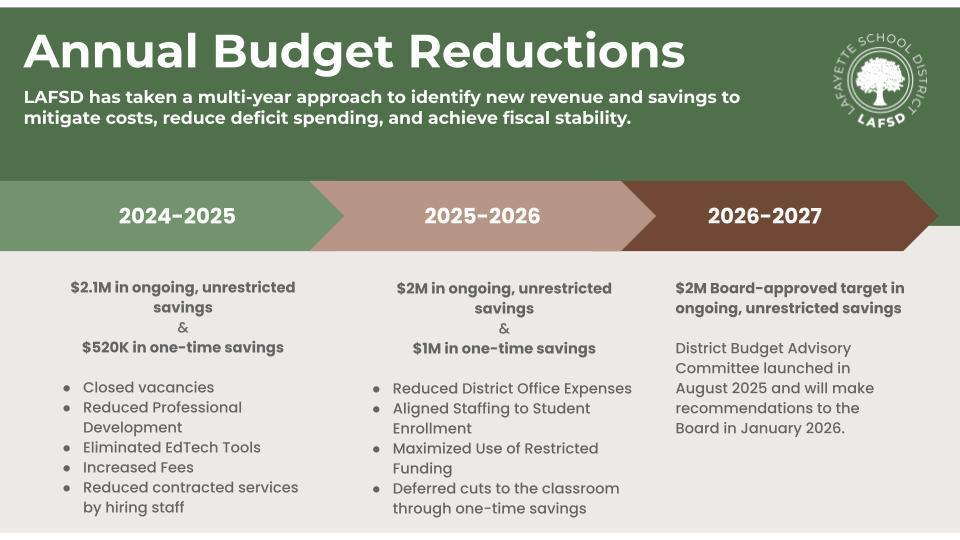

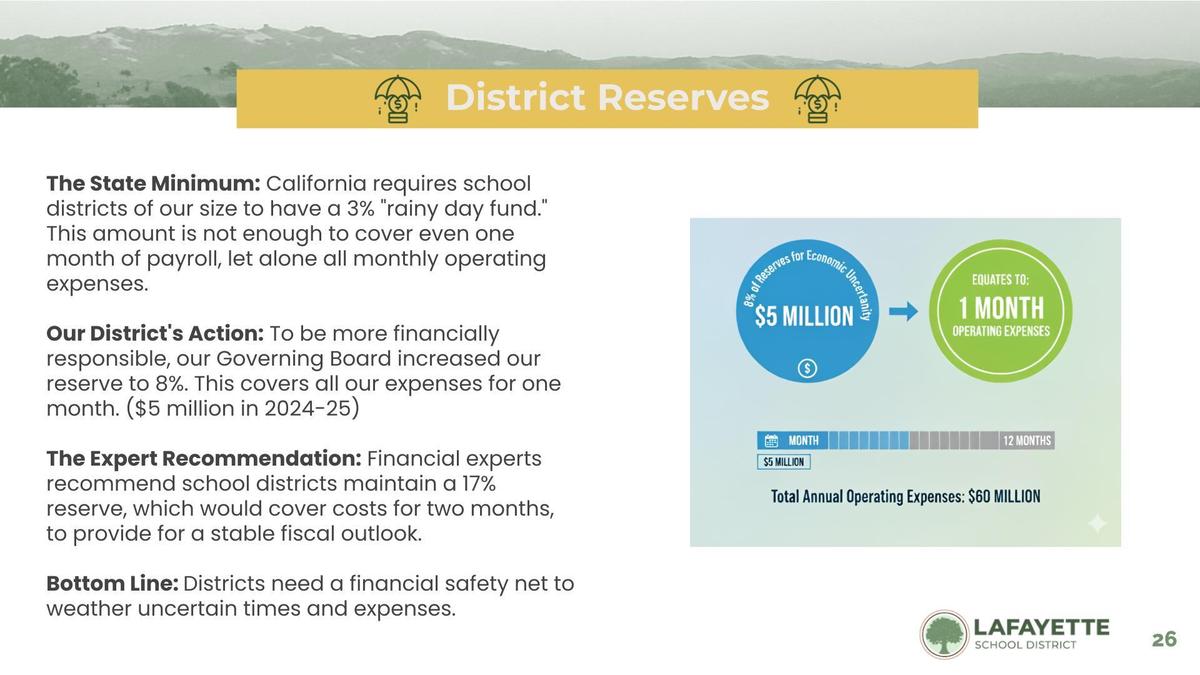

Responsible Fiscal Stewardship and Budget Reductions

LAFSD has taken a multi-year approach to identify new revenue and savings to mitigate costs, reduce deficit spending, and achieve fiscal stability.

For the 24-25 school year, the Governing Board adopted $2.1M in savings and reductions recommended by the District Budget Advisory Committee. However, costs continued to exceed revenue and the District is relying on one-time reserves to cover the gap. For 2025-26, the Board approved an additional $2M in ongoing savings and reductions. The District is facing another $2 million savings and reduction target for 2026-27. These changes represent 10% of the District's general fund budget.

year, the Governing Board adopted $2.1M in savings and reductions recommended by the District Budget Advisory Committee. However, costs continued to exceed revenue and the District is relying on one-time reserves to cover the gap. For 2025-26, the Board approved an additional $2M in ongoing savings and reductions. The District is facing another $2 million savings and reduction target for 2026-27. These changes represent 10% of the District's general fund budget.

Missed our Budget Town Halls?

See below for the presentations and additional resources regarding our budget reductions.

Your Voice Matters!

Taking Action Now for the Future: Continued Fiscal Stewardship

Thanks to the Lafayette community, Lafayette elementary and middle schools are currently supported by two parcel taxes:

| Measure J&B Parcel Tax (2014) | Measure L (2020) |

|

Ballot Language:

"Without increasing existing tax rates, and to preserve high quality academic programs in Lafayette elementary and middle schools in math, science, art, and music; attract and retain highly qualified teachers; keep classroom technology, science labs and instructional materials up-to-date, and maintain manageable class sizes, shall Lafayette School District extend the expiring $539 local school tax, with an exemption for seniors, an annual cost-of-living adjustment, and with all money staying in Lafayette to benefit our public schools?[4]

|

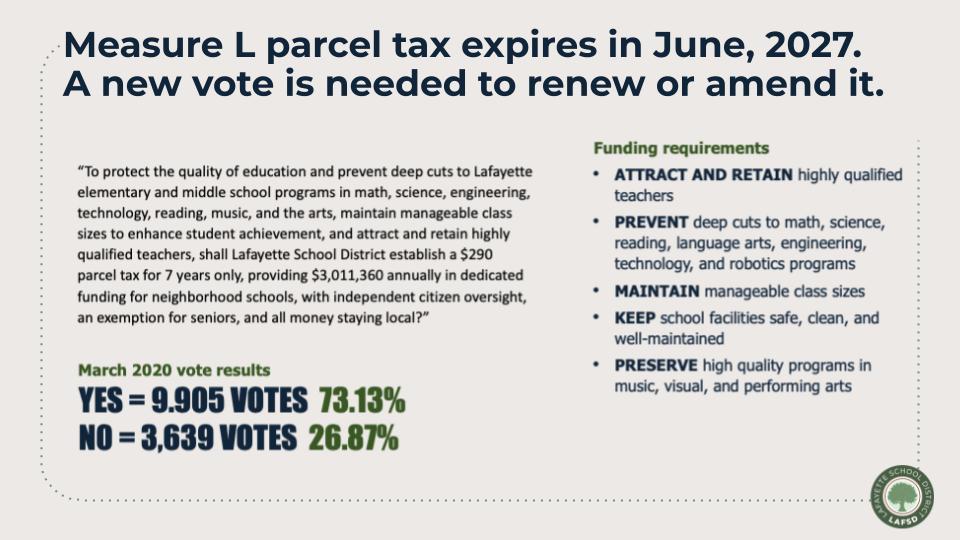

Ballot Language: "To protect the quality of education and prevent deep cuts to Lafayette elementary and middle school programs in math, science, engineering, technology, reading, music, and the arts, maintain manageable class sizes to enhance student achievement, and attract and retain highly qualified teachers, shall Lafayette School District establish a $290 parcel tax for 7 years only, providing $3,011,360 annually in dedicated funding for neighborhood schools, with independent citizen oversight, an exemption for seniors, and all money staying local.” View the full Measure L Resolution here. |

|

Terms:

|

Terms:

|

Our locally elected Governing School Board will need to make important decisions by 2026. We’re also exploring the feasibility of asking our community to renew and possibly increase LAFSD’s Measure L parcel tax set to expire in 2027.

As of January 2026, the Board has engaged in a series of public discussions regarding the expiration of Measure L and the feasibility of a parcel tax renewal. These discussions have included: